As President-elect Trump prepares to take office, Georgia's student loan borrowers are likely to face significant changes in the coming years. Here's what we can expect for Georgia's student loan debt under the new administration:

Trump's administration is poised to unwind many of President Biden's student debt relief initiatives. This could have a substantial impact on Georgia, where:

- Approximately 1.7 million residents owe over $70.1 billion in student loans

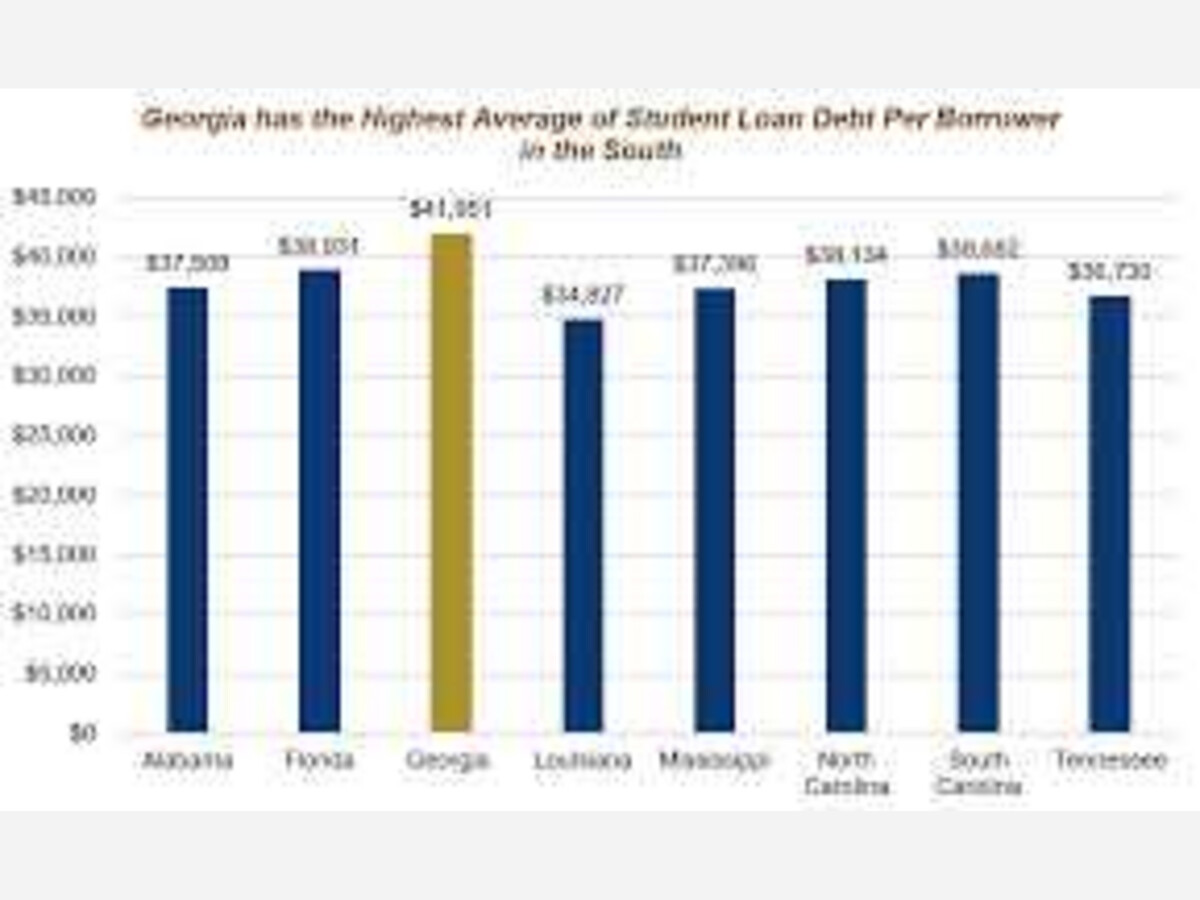

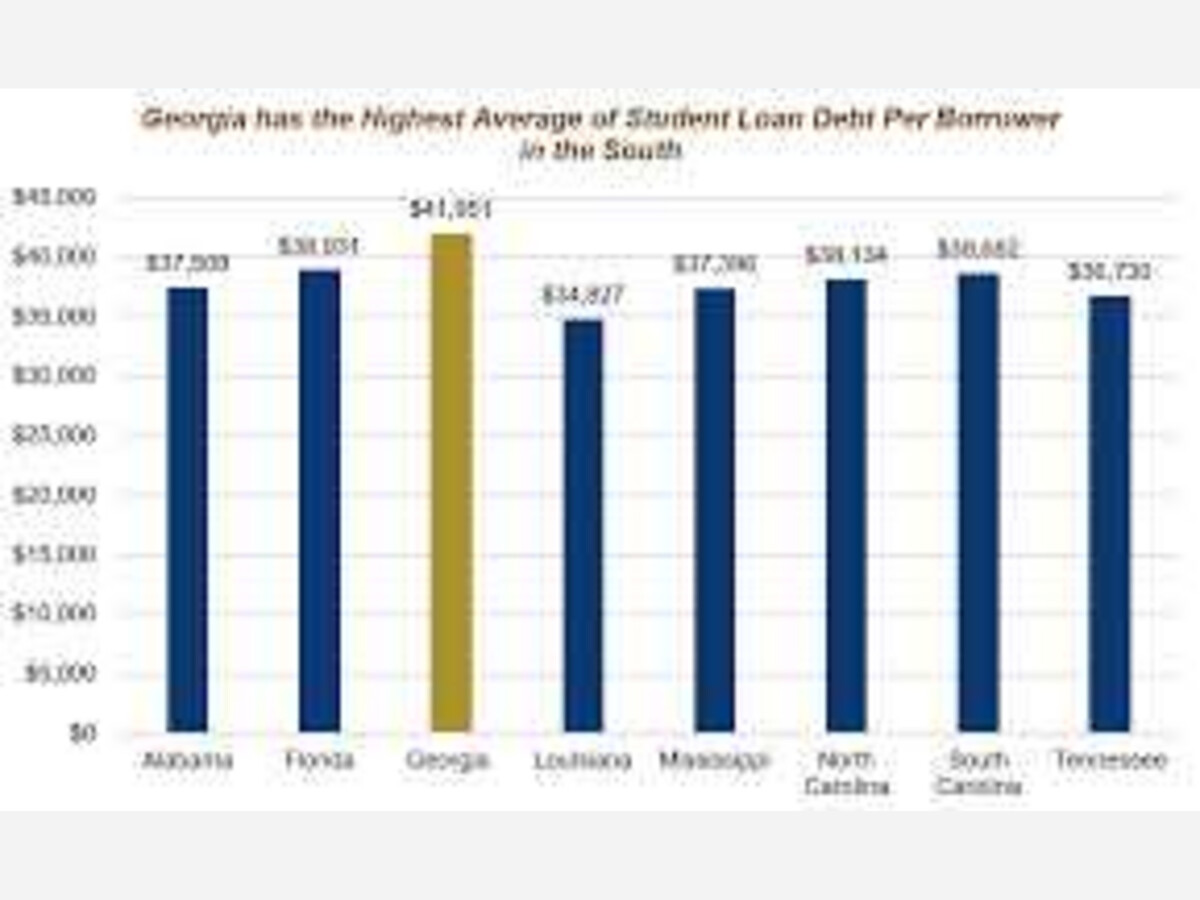

- The average debt per borrower is about $42,026, higher than the national average of $36,200

- Georgia ranks third in the nation for student loan debt per borrower

Several key programs may be affected:

- The Saving on a Valuable Education (SAVE) plan, which offered reduced monthly payments and a new path to loan forgiveness, is likely to be discontinued

- Biden's "Plan B" for loan forgiveness, targeting older loans and accrued interest, may be halted

- Other income-driven repayment plans could face restrictions or elimination

While Trump's specific plans for student loans remain unclear, his administration may consider:

- Proposing a new income-driven repayment program capping payments at 12.5% of income with forgiveness after 15 years

- Potentially transferring the federal student loan program to a new government entity

- Resuming collection on defaulted federal student debt, which has been paused since the pandemic began

The changes could significantly affect Georgia's higher education system and students:

- The lack of comprehensive need-based aid in Georgia, combined with potential federal policy changes, may exacerbate the student debt crisis

- Black students and women in Georgia, who carry higher debt burdens, may be disproportionately affected

- The state's efforts to mitigate student loan debt, such as utilizing education lottery funds, may become more critical

- The Public Service Loan Forgiveness (PSLF) program, which many Georgian public servants rely on, could face restrictions

- Previous loan forgiveness granted under Biden (affecting about 16,340 Georgians with over $229 billion in debt) may be subject to review

Given these potential changes, Georgia's student loan borrowers should prepare for various scenarios, including possible increases in monthly payments and reduced options for loan forgiveness. State-level initiatives to address the student debt crisis may become increasingly important in the absence of federal relief programs.